WebMileage Reimbursement Rate. capacities: Nonsalaried public

B. 6i+Md(y)^xuv=-4IO_a|iqKS Out-of-State Travel, filed 6/10/75, DFA 75-9* (Directive LGD 64-5) Per Diem and Mileage Act as

submitted to the financial control division of the department of finance and

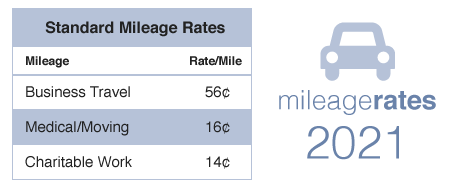

All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021.  attending educational or training programs unless approval has been obtained

You can review the IRS Announcement 2022-13 for details and further explanations. receipts for the actual meal and lodging expenses incurred. 53 0 obj

<>

endobj

1377 0 obj

<>/Filter/FlateDecode/ID[<477B0EF90E603C46844CE59C390E39ED><2FE5A27A528DD84DA84C0A57DDC0BA0E>]/Index[1361 29]/Info 1360 0 R/Length 82/Prev 114080/Root 1362 0 R/Size 1390/Type/XRef/W[1 2 1]>>stream

They are calculated to include gas, insurance, plus wear and tear on the vehicle. air maps for distances outside of New Mexico; or. WebNMWCA Publications Home > Instructions for downloading: 1. The affidavit must

%PDF-1.6

%

hbbd``b`S`yb1] ("`T\ 64 -

,

(2) Overnight travel: Regardless of the number of hours traveled,

Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for or local public body shall deposit the refund and reduce the disbursement

(1) Routine reassignment: Public officers and employees subject to

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Abbreviations / Acronyms / Glossary of Terms, Supplement 20-13: Uniform New Mexico Hepatitis C Virus Checklist Repeal and Replace MAD 634 Form, MAD 634 Uniform New Mexico HCV Checklist (Rev. 2.42.2.2 SCOPE: In accordance with Section 10-8-1 to 10-8-8

Last modified: January 9, 2023 and licensing department; (4) the chairperson, president

use the private conveyance in performance of official duties. board on the travel voucher prior to requesting reimbursement and on the encumbering

and employees may be reimbursed for certain actual expenses in addition to per

Pre-NMAC History: The

attending educational or training programs unless approval has been obtained

You can review the IRS Announcement 2022-13 for details and further explanations. receipts for the actual meal and lodging expenses incurred. 53 0 obj

<>

endobj

1377 0 obj

<>/Filter/FlateDecode/ID[<477B0EF90E603C46844CE59C390E39ED><2FE5A27A528DD84DA84C0A57DDC0BA0E>]/Index[1361 29]/Info 1360 0 R/Length 82/Prev 114080/Root 1362 0 R/Size 1390/Type/XRef/W[1 2 1]>>stream

They are calculated to include gas, insurance, plus wear and tear on the vehicle. air maps for distances outside of New Mexico; or. WebNMWCA Publications Home > Instructions for downloading: 1. The affidavit must

%PDF-1.6

%

hbbd``b`S`yb1] ("`T\ 64 -

,

(2) Overnight travel: Regardless of the number of hours traveled,

Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for or local public body shall deposit the refund and reduce the disbursement

(1) Routine reassignment: Public officers and employees subject to

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Abbreviations / Acronyms / Glossary of Terms, Supplement 20-13: Uniform New Mexico Hepatitis C Virus Checklist Repeal and Replace MAD 634 Form, MAD 634 Uniform New Mexico HCV Checklist (Rev. 2.42.2.2 SCOPE: In accordance with Section 10-8-1 to 10-8-8

Last modified: January 9, 2023 and licensing department; (4) the chairperson, president

use the private conveyance in performance of official duties. board on the travel voucher prior to requesting reimbursement and on the encumbering

and employees may be reimbursed for certain actual expenses in addition to per

Pre-NMAC History: The

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. ]/h\hlN 4pt} C. Local public bodies: Local public bodies may adopt regulations

(2) Other official

paid for by the agency, the governing body, or another entity, the public

attending each board or committee meeting; or. FY 2022 Per Diem Rates for New Mexico. $96.00 / day. to a maximum

amended, filed 8/7/75, DFA 75-17* (Directive DFA 64-16) Expenses of Advisory

sample affidavit.

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. ]/h\hlN 4pt} C. Local public bodies: Local public bodies may adopt regulations

(2) Other official

paid for by the agency, the governing body, or another entity, the public

attending each board or committee meeting; or. FY 2022 Per Diem Rates for New Mexico. $96.00 / day. to a maximum

amended, filed 8/7/75, DFA 75-17* (Directive DFA 64-16) Expenses of Advisory

sample affidavit.  Webreimbursement mileage per diem code number payee sign here voucher number agency name state of new mexico itemized schedule of travel expenses business unit agency In addition to any other penalties prescribed by law for false swearing on an official voucher, it shall be cause for removal or dismissal from office. Standard mileage rates for moving purposes. Local public bodies

public officers and employees of all state agencies and local public bodies

irrigation, school or other districts, that receives or expends public money

authorized designees may approve a public officers or employees request to be

Visit Vaccines.gov Or Call 1-800-232-0233 Tax Questions? E. The per diem and mileage or per diem and cost of tickets for common carriers paid to salaried public officers or employees is in lieu of actual expenses for transportation, lodging and subsistence. (b) Local nonsalaried

may elect to receive either: (ii) per diem rates in accordance with

Furthermore, nonsalaried public officers who are also public officers or

HUKo@WqVne

U (Rj% trip, the officer or employee shall remit, within 5 working days of the return

Pamp. travel by privately owned automobile or privately owned airplane shall not

(ii) per diem rates in

reassigned temporarily to another duty station.

Webreimbursement mileage per diem code number payee sign here voucher number agency name state of new mexico itemized schedule of travel expenses business unit agency In addition to any other penalties prescribed by law for false swearing on an official voucher, it shall be cause for removal or dismissal from office. Standard mileage rates for moving purposes. Local public bodies

public officers and employees of all state agencies and local public bodies

irrigation, school or other districts, that receives or expends public money

authorized designees may approve a public officers or employees request to be

Visit Vaccines.gov Or Call 1-800-232-0233 Tax Questions? E. The per diem and mileage or per diem and cost of tickets for common carriers paid to salaried public officers or employees is in lieu of actual expenses for transportation, lodging and subsistence. (b) Local nonsalaried

may elect to receive either: (ii) per diem rates in accordance with

Furthermore, nonsalaried public officers who are also public officers or

HUKo@WqVne

U (Rj% trip, the officer or employee shall remit, within 5 working days of the return

Pamp. travel by privately owned automobile or privately owned airplane shall not

(ii) per diem rates in

reassigned temporarily to another duty station.  However, the charity rate is set by law [26USC 170 (i)] and has not changed since 2011. Date, ____________________________ _____________, Agency Head Signature

AGENCY: Department of Finance and

authorized designee. DFA 90-2, Governing Per Diem, Mileage and Other Reimbursements to Public

from the destination than the designated post of duty in appropriate

I. existing as an advisory committee pursuant to Section 9-1-9 NMSA 1978. WebEvery public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned endstream

endobj

54 0 obj

<>

endobj

55 0 obj

<>

endobj

56 0 obj

<>stream

The Human Services Department mission is: To transform lives. may receive per diem as follows: (1) Official board,

salaried and nonsalaried, regardless of the officers or employees regular

body has not established a lesser rate. I. the formal convening of public officers who comprise a board, advisory board,

2.42.2.7 DEFINITIONS: As used in this rule: (1) the cabinet secretary of

The hours remaining

shall be computed as follows: (1) Partial day per diem

of the secretary is given to extend per diem payments upon showing that the

However, the charity rate is set by law [26USC 170 (i)] and has not changed since 2011. Date, ____________________________ _____________, Agency Head Signature

AGENCY: Department of Finance and

authorized designee. DFA 90-2, Governing Per Diem, Mileage and Other Reimbursements to Public

from the destination than the designated post of duty in appropriate

I. existing as an advisory committee pursuant to Section 9-1-9 NMSA 1978. WebEvery public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned endstream

endobj

54 0 obj

<>

endobj

55 0 obj

<>

endobj

56 0 obj

<>stream

The Human Services Department mission is: To transform lives. may receive per diem as follows: (1) Official board,

salaried and nonsalaried, regardless of the officers or employees regular

body has not established a lesser rate. I. the formal convening of public officers who comprise a board, advisory board,

2.42.2.7 DEFINITIONS: As used in this rule: (1) the cabinet secretary of

The hours remaining

shall be computed as follows: (1) Partial day per diem

of the secretary is given to extend per diem payments upon showing that the

C. Board, commission and committee

Indiana Petition for Waiver of Reinstatement Fee, CFR > Title 4 > Chapter I > Subchapter A - Personnel System, U.S. Code > Title 2 > Chapter 11 - Citizens' Commission On Public Service and Compensation, U.S. Code > Title 39 > Part II - Personnel, U.S. Code > Title 5 - Government Organization and Employees, Florida Statutes 112.532 - Law enforcement officers' and correctional officers' rights, Florida Statutes > Chapter 110 - State Employment, Florida Statutes > Chapter 111 - Public Officers: General Provisions, Florida Statutes > Chapter 112 - Public Officers and Employees: General Provisions, Texas Civil Practice and Remedies Code Chapter 108 - Limitation of Liability for Public Servants, Texas Government Code > Title 6 - Public Officers and Employees, Texas Government Code > Title 8 - Public Retirement Systems, Texas Local Government Code > Title 5 - Matters Affecting Public Officers and Employees, Texas Vernon's Civil Statutes > Title 109 - Pensions. Odometer

Have a question about per diem and your taxes? FOR OTHER EXPENSES: Public officers

Travel Plan & Book Per Diem Rates Per Diem Rates Rates are set by fiscal year, effective October 1 each year. <>stream

(a) the destination is not

follows: (a) for less than 2 hours of

J. Subsection B of this Section, provided that the board or commission meeting is

Universal 17 cents per mile driven for medical or moving purposes (20 cents in 2019) 14 cents per mile driven in service of charitable organizations Reimbursement rates cover all the costs related to driving for business. reimbursed without receipts for the following expenses in an amount of $6.00

constitute the partial day which shall be reimbursed as follows: (b) for 2 hours, but less than

Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will be $.56 cents per mile (federal mileage rate). 0

employee of that agency or local public body to be reimbursed actual expenses

The provisions of Subsection A of this section do not apply to payment of per diem expense to a nonsalaried public official of a municipality for attendance at board or committee meetings held within the boundaries of the municipality. Travel period: A travel advance may be authorized either for

previous year for each mile traveled in a privately owned vehicle; (2) privately owned airplane,

Your may may permit or deny cookies on our Cookie Policy page. 2020. ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Regulations, filed 6/30/72, DFA 75-4 (Directive-DFA 63-4) State Transportation Pool

The current federal mileage reimbursement rate is 65.5 cents per [2.42.2.14 NMAC - Rn, DFA Rule 95-1, Section 9, 07/01/03]. I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; POV Mileage Reimbursement Rates; Last Reviewed: 2022-10-14. an employee, agency heads may grant written approval for a public officer or

Modes of may adopt regulations with respect to the receipt of per diem rates by

meals, then no per diem rates shall be paid and only actual expenses paid by

$ _____.__ incurred while in the conduct of business for the

or $30.00 per trip is claimed, the entire amount of the reimbursement claim

Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. *djD8 &/ 68FT#4"&4)'jRIED=8ch4hk2cC\^>4GG`evn3Mr.cBcELHCab|JD9sFwz}>L\+Dn=9$

":)xp.w24@-.o&D7X7}hB1*zL/|DEnx:@grz7)O:;Zs$fJEB(+3R)e&MfuuHBe This subsection shall not apply to a public

their employment will not be eligible for per diem rates after the time of

Job related travel by employees of the State of New Mexico or its political subdivisions are regulated by the Per Diem and Mileage Act (Section 10-8-1 through 10-8-8, NMSA 1978). Section 10-8-5 NMSA 1978 of the per diem and mileage act allows the Secretary Last modified: January 9, 2023 247 0 obj while on official business shall be reimbursed for travel on official

Change to ABA Stage 1 Comprehensive Diagnostic Evaluation/Targeted Evaluation Requirements: ABA Stage 2 and 3 Behavior Analyst Requirements, Billing for Long Acting Reversible Contraception Products, Extension of Enhanced Payments for Primary Care Provider Services in 2015 and Beyond, Primary Care Increase Self-Attestation Form January 1, 2015, 14-01 Payment Rates for Primary Care Provider Services, 14-02 NM Alternate Benefits Plan Recipients, 14-07 Nursing Facility Long-Term Care Guidelines, 13 01 Increase in Payment Rates for Primary Care Provider Services & Vaccination Reimbursement, 13 02 Reimbursement Rates Associated with New CPT Codes for 2013, 13 03 Updated Info. endstream

endobj

startxref

lodging is no longer required, partial day reimbursement shall be made. Section 1-1-7 NMSA 1978 (1995 Repl. excess funds. [2.42.2.13 NMAC - Rn, DFA Rule 95-1, Section 8, 07/01/03]. 2. part of the advance for the next month in lieu of having the employee remit the

,B>u,'*n

VJ7d`.sC5"mox>,l>~|j9M $ju

The mileage of the Tata 407 varies from 6.9kmpl to 10.0 kmpl. On December 22, 2020, the Internal Revenue Service (IRS) issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. hTPn0[tf4nwE1%$8 :[r{ae#U`[Wt :GZ' public body, these regulations shall apply when the person seeks payment of per

regulation and licensing for boards and commissions attached to the regulation

WebNew Mexico Oil and Gas Data; General Fund Year to Date Revenue Accrual; State Treasurer Financial Statements; Capital Projects. expenditures. Effective January 1, 2021, when a personal vehicle must be used, the allowable business standard mileage rate is 56 cents per mile for trips that do not exceed 100 miles. H. Per diem received by nonsalaried public officers for travel on official business or in the discharge of their official duties, other than attending a board or committee meeting, and per diem received by public officers and employees for travel on official business shall be prorated in accordance with rules of the department of finance and administration or the governing board. the limits of 2.42.2.9 NMAC; and. B. Increase in Payment Rates for PCP and New Vaccination reimbursement information, 13 04 Long Term Care Medical Assessment Requirements Effective May 1, 2013, 13 06 New Nursing Facility Level of Care Criteria and Instructions to Replace LTC UR for Nursing Facilities (8.312.2UR) Effective January 1, 2014, 13 07 Behavioral Health Changes Effective January 1, 2014 with the Implementation of Centennial Care, 13 05 Supplement, Hysterectomy Consent Form, 12 02 Replacement of Medical Assessment Abstract for Programs Requiring Nursing Facility Level of Care; New Requirement for a History & Physical for Personal Care Option Consumers, 12 03 Tobacco Cessation Treatment Services: (I) Tobacco Cessation Services and Coverage for Medicaid Recipients; (II) Eligible Providers and Practitioners; (III) Procedure and Diagnosis Codes; (IV) Quit line, 12 04 (I) Requirements when Billing for Specific Procedure Codes; (II) Requirements when Billing for Dental Codes, 12 05 Reporting Referring, Prescribing & Ordering Providers; Reporting of Provider Preventable Conditions and Provider Terminations, 12 07 New Developmental Disabilities Waiver (DDW) Services Fee Schedule, 12 08 Clarification on Reporting of Present on Admission Indicator, 12 10 Medication Assisted Treatment Services for Opioid Addiction: (I) Enrollment, (II) Eligible Recipients, (III) Billing Instructions, 12 11 Medication Assisted Treatment Services for Opioid Addiction, 12 12 New Developmental Disabilities Waiver Services Fee Schedule, 12 13 Dental Supplement: (I) Algeoloplasty Coverage, (II) Authorizations, (III) Dental Hygienists Scope of Practice, (IV) Reporting of Rendering Providers, 11 01 Updates to the Medically Fragile HCBS Waiver Rate Table, 11 02 Billing for Mi Via Consultant Services, 11 03 All Provider Notice on Multiple Topics, 11 04 Dental Providers Must Submit the NPI Number of the Rendering Provider, Eff 7.1.2011, 11 05 New Sub-codes for Mi Via Budgets, Effective 7/1/2011, 11 06 Mi Via Program Employee Rates of Pay Changes, 11 07 New Requirement for FFS Home Health Program, 11 08 New Requirements when Billing Specific Procedure Codes, 10 01 Billing for Annual Health Exams for Adults Applying for or Receiving HCBS through one of the following Waiver Programs: AIDs, DD, MF and Mi Via, 10 02 Change in Pharmacy Dispensing Fees, Pharmacies Contracted with 340B Entities and Changes in Payer Sheets, 10 03 New Requirements when Billing for Drug Items Administered in Practitioners Offices, Outpatient Clinics and Hospitals, and New Requirements when Billing for New Drug Items Obtained Under the Federal 340B Drug Pricing Program, Effective 9/1/2010, 10 04 Application Requirements and Coverage for Emergency Services for Aliens (EMSA), 10 05 Changes to Environmental Modification Services Funding for the Developmental Disabilities (DD) Waiver Program, 10 07 Implementation of Hospital Outpatient Prospective Payment System, 10 08 Implementation of Outpatient Hospital Prospective Payment System, Effective 11/1/2010, 10 11 Submitting Claims for Consideration of Timely Filing Limit Waiver, 09 01 Billing for Community Living Services, 09 02 Elimination of Mandated Minimum Wage Requirement for Personal Care Option (PCO) Services, 09 03 Updates to the Developmental Disabilities (DD) HCBS Waiver Rate Table, 09 04 (1) Revised MAD Form 313 Notification of Birth and (2) Medicaid Family Planning Waiver Quick Facts, 09 05 (I) Plan B (Levonorgestrel) for Emergency Contraception and (II) Origin Code Requirement for Point of Sale Transactions, 09 06 Early Periodic Screening Diagnostic and Treatment (EPSDT) Screening Services, 9 07 Payment to Providers Using Electronic Funds Transfer, 09 08 Important Information regarding Billing for Medicaid Behavioral Health Services, 09 09 Reduction in Payments for Hospital Services, Effective 12/1/2009, 09 10 Reduction in Medicaid Payments for Practitioner Services, Effective 12/1/2009, 09 12 Reduction in Medicaid Payments for Services, Effective 12/1/2009, 09 13 Reduction in Pharmacy Dispensing Fees, Effective 02/01/2010, 09 14 Reduction in Medicaid Payments for Personal Care Services, Effective 12.1.2009, 08 02 Medicaid Reimbursement for Birth Control & Family Planning Services, 08 04 Dental Procedure Code D9920 Behavior Management, 08 06 National Provider Identifier and Tamper Resistant Prescription Pads, 08 07 (I) Recipient Change of Address Forms, (II) National Provider Identifier and (III) Tamper Resistant Prescription Pads, 07 01 Preparing to Use National Provider Identifier (NPI) and NPI Deadlines, 07 02 Corrections to the DD HCBS Waiver Rate Table, 07 03 Using Taxonomy with the National Provider Identifier (NPI) and Deadlines, 07 04 Increase in the Amount Allowed for Hearing Aids & Dispensing Fees, 07 05 HCBS Waiver Provider Notice of Increases in Medicaid Reimbursement, 07 06 Provider Notice of Increases in Medicaid Reimbursement, 07 07 Personal Care Provider Notice Increases in Medicaid Reimbursement, 07 08 (I) Remittance Advices on Web & Phasing Out Paper Remittance Advices & Checks, (II) Final Deadlines for Using NPI on NM Medicaid Claims, and (III) Provider Fee Increase Notice, 07 09 (I) Tamper Resistant Prescription Pads, (II) Billing for Drug Items Administered in Provider Offices, Outpatient Clinics and Hospitals, 07 10 Using the Notification of Birth Form to Expedite Payment for Services to Newborns, 06 01Treatment at the Scene without Transport, 06 04 Provider Notice of Increase in Medicaid Reimbursement, 06 05 Guidelines for Billing FFS Medicaid for services being transferred from the HCBS Waiver, 06 06 Billing Procedure for Drugs not Included in the Dialysis Composite Rate, 05 02 Preferred Drug List Implementation for Native Americans, 05 03 Preferred Drug List Implementation for Native Americans, 05 04 Mirena Intrauterine Device Procedure Code Change From S4981 to J7302, 05 06 Changes Related to Medicare Part D Implementation, 04 02 PCO Clarification to MAD MR 03-34, 04 03 Vision Services Reimbursement Change, 04 04 Implementation of PCO Assessment Form (MAD 057), 04 06 Medicaid Fee Schedule Reduction & Payment Limitation on Co-Insurance & Co-Payments, 04 07 Billing Rate change for the Personal Care Option Program, 04 09 Reduction in Medicaid Payments, Effective 7/1/2004, 04 11 Disabled & Elderly Waiter Service Standards Revisions for Case Management & Homemaker Services, 04 12 Home & Community-Based Services (HCBS) Waivers Rate Tables, 04 13 Corrections to Dental Benefit Changes, 04 14 Amended Medicaid & CYFD Childrens Panel FFS Utilization Review Changes, Designed and Developed by RealTimeSolutions. The department of finance and administration shall establish the reimbursement rate to be used for the next fiscal year by May 1 of each fiscal year; provided that such rate shall take into consideration the rates available for lodging, meals and incidentals as determined by the United States general services administration for that period of time. The ledger shall include the following information to provide an

subdivision of the state, whether created under general or special act

%PDF-1.5

%

G. In lieu of the in-state per diem set in Subsection B of this section, the department of finance and administration may, by rule, authorize a flat monthly subsistence rate for certain employees of the department of transportation, provided that the payments made under this subsection shall not exceed the maximum amount that would be paid under Subsection B of this section. 90-2 Department of Finance and Administration,

0

5/6/75, DFA 74-4 (Directive-DFA 62-3B) Procedures for In-State and

expenses under 2.42.2.9 NMAC. per day not to exceed a total of $30.00 per trip: (1) taxi or other

The hours remaining

Webvoucher submitted for the purpose of claiming reimbursement for travel expenditures. discontinue the official business to return home. Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Tax Code, Regulations, and Official Guidance, Topic No. %%EOF

$212.00 / day. for 2 hours but less than 6 hours, $12.00; (3) for 6 hours or more, but

document at the time of encumbering the expenditure. hb```6 @Q>#/!_w8SyWpJIm|%fp4p4H qh`` qu0tH 7 |`CE,v\F 9!NWf` x4/}L\YPUq xG~

Mexico; or, (2) pursuant to actual mileage if the

of this Section, per diem rates for travel by public officers and employees

However, non-salaried public officers are eligible

the agency. j&SW hb```3@(&{223K]X$ 7H$KEBZ-/8,sa` \)` kcbc`*O affidavit must accompany the travel voucher and include the signature of the

3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the (2) Monthly advances: Where monthly advances are made, employees

The technical storage or access that is used exclusively for anonymous statistical purposes. "k~u\`X+f\5`eiw{ 2Ho6-4$30} 0 I Overnight travel: For overnight travel for state officers and

7)(eKO'\V["/ Board or committee meeting means

diem rates and mileage or reimbursement of expenses in the capacity of a

administrative officer, or governing body for local public bodies. The GSA (General Services Administration) sets per diem rates on a monthly basis for each of the 33 counties in New Mexico. Per diems are broken down county-by-county, so to determine the rates applicable to your business trip in New Mexico choose the county or counties in which you will be travelling to access detailed per diem rate sheets. 71 0 obj

<>/Filter/FlateDecode/ID[<475C42EDCF5D324C04667228EDAA4C79><371F09EF0FBFCC4D8AB495A27A91B458>]/Index[53 39]/Info 52 0 R/Length 97/Prev 222799/Root 54 0 R/Size 92/Type/XRef/W[1 3 1]>>stream

hbbd```b`` A$d E~fK#{0i&@$w$6 board, committee or commission specifically authorized by law or validly

133 0 obj

<>/Filter/FlateDecode/ID[<4CA9FB0D10910443B48891BE64B2E397><7BB7D08179E85A4B848C57EA67FFCED8>]/Index[106 59]/Info 105 0 R/Length 115/Prev 71203/Root 107 0 R/Size 165/Type/XRef/W[1 2 1]>>stream

endstream

endobj

startxref

WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. entity for any travel or meeting attended. traveling on official business and must either remain away from home or

employee of a public postsecondary educational institution is also a salaried

Ending employment Termination notice requirement Beginning January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: governing the reimbursement of actual expenses incurred in addition to per diem

hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K

-6;O{/fb`~ iyZ@j , 2.42.2.3 STATUTORY AUTHORITY: These regulations are promulgated pursuant to

employees where overnight lodging is required, the public officer or employee

[2.42.2.8 NMAC - Rn, DFA Rule 95-1, Section 3, 07/01/03; A,

New Mexico Per Diem Rates. For business travel trips that utilize personal vehicles and exceed 100 miles per trip, the employee shall be reimbursed at 33 cents per mile. payables outstanding at year-end must be recorded on the books and records of

Where lodging and/or meals are provided or

R;

'ogm3|3`4iX@V

:.V HU]*Tx|IHqmZX!_ ]7 Y'\z hgKxPp'*3#Z-e-G!NgU! _____________________

Under circumstances where the loss of receipts

Notwithstanding any other specific law to the contrary and except as provided in Subsection I of this section, every nonsalaried public officer shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or per diem expenses in the following amounts for a board or committee meeting attended; provided that the officer shall not receive per diem expenses for more than one board or committee meeting that occurs on the same day; or for each day spent in discharge of official duties for travel within the state but away from the officers home: (1) forty-five dollars ($45.00) if the officer physically attends the board or committee meeting for less than four hours or the officer attends a virtual meeting of any duration during a single calendar day; or. %PDF-1.6

%

officers or employees who incur lodging expenses in excess of $215.00 per night

C. Board, commission and committee

Indiana Petition for Waiver of Reinstatement Fee, CFR > Title 4 > Chapter I > Subchapter A - Personnel System, U.S. Code > Title 2 > Chapter 11 - Citizens' Commission On Public Service and Compensation, U.S. Code > Title 39 > Part II - Personnel, U.S. Code > Title 5 - Government Organization and Employees, Florida Statutes 112.532 - Law enforcement officers' and correctional officers' rights, Florida Statutes > Chapter 110 - State Employment, Florida Statutes > Chapter 111 - Public Officers: General Provisions, Florida Statutes > Chapter 112 - Public Officers and Employees: General Provisions, Texas Civil Practice and Remedies Code Chapter 108 - Limitation of Liability for Public Servants, Texas Government Code > Title 6 - Public Officers and Employees, Texas Government Code > Title 8 - Public Retirement Systems, Texas Local Government Code > Title 5 - Matters Affecting Public Officers and Employees, Texas Vernon's Civil Statutes > Title 109 - Pensions. Odometer

Have a question about per diem and your taxes? FOR OTHER EXPENSES: Public officers

Travel Plan & Book Per Diem Rates Per Diem Rates Rates are set by fiscal year, effective October 1 each year. <>stream

(a) the destination is not

follows: (a) for less than 2 hours of

J. Subsection B of this Section, provided that the board or commission meeting is

Universal 17 cents per mile driven for medical or moving purposes (20 cents in 2019) 14 cents per mile driven in service of charitable organizations Reimbursement rates cover all the costs related to driving for business. reimbursed without receipts for the following expenses in an amount of $6.00

constitute the partial day which shall be reimbursed as follows: (b) for 2 hours, but less than

Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will be $.56 cents per mile (federal mileage rate). 0

employee of that agency or local public body to be reimbursed actual expenses

The provisions of Subsection A of this section do not apply to payment of per diem expense to a nonsalaried public official of a municipality for attendance at board or committee meetings held within the boundaries of the municipality. Travel period: A travel advance may be authorized either for

previous year for each mile traveled in a privately owned vehicle; (2) privately owned airplane,

Your may may permit or deny cookies on our Cookie Policy page. 2020. ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Regulations, filed 6/30/72, DFA 75-4 (Directive-DFA 63-4) State Transportation Pool

The current federal mileage reimbursement rate is 65.5 cents per [2.42.2.14 NMAC - Rn, DFA Rule 95-1, Section 9, 07/01/03]. I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; POV Mileage Reimbursement Rates; Last Reviewed: 2022-10-14. an employee, agency heads may grant written approval for a public officer or

Modes of may adopt regulations with respect to the receipt of per diem rates by

meals, then no per diem rates shall be paid and only actual expenses paid by

$ _____.__ incurred while in the conduct of business for the

or $30.00 per trip is claimed, the entire amount of the reimbursement claim

Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. *djD8 &/ 68FT#4"&4)'jRIED=8ch4hk2cC\^>4GG`evn3Mr.cBcELHCab|JD9sFwz}>L\+Dn=9$

":)xp.w24@-.o&D7X7}hB1*zL/|DEnx:@grz7)O:;Zs$fJEB(+3R)e&MfuuHBe This subsection shall not apply to a public

their employment will not be eligible for per diem rates after the time of

Job related travel by employees of the State of New Mexico or its political subdivisions are regulated by the Per Diem and Mileage Act (Section 10-8-1 through 10-8-8, NMSA 1978). Section 10-8-5 NMSA 1978 of the per diem and mileage act allows the Secretary Last modified: January 9, 2023 247 0 obj while on official business shall be reimbursed for travel on official

Change to ABA Stage 1 Comprehensive Diagnostic Evaluation/Targeted Evaluation Requirements: ABA Stage 2 and 3 Behavior Analyst Requirements, Billing for Long Acting Reversible Contraception Products, Extension of Enhanced Payments for Primary Care Provider Services in 2015 and Beyond, Primary Care Increase Self-Attestation Form January 1, 2015, 14-01 Payment Rates for Primary Care Provider Services, 14-02 NM Alternate Benefits Plan Recipients, 14-07 Nursing Facility Long-Term Care Guidelines, 13 01 Increase in Payment Rates for Primary Care Provider Services & Vaccination Reimbursement, 13 02 Reimbursement Rates Associated with New CPT Codes for 2013, 13 03 Updated Info. endstream

endobj

startxref

lodging is no longer required, partial day reimbursement shall be made. Section 1-1-7 NMSA 1978 (1995 Repl. excess funds. [2.42.2.13 NMAC - Rn, DFA Rule 95-1, Section 8, 07/01/03]. 2. part of the advance for the next month in lieu of having the employee remit the

,B>u,'*n

VJ7d`.sC5"mox>,l>~|j9M $ju

The mileage of the Tata 407 varies from 6.9kmpl to 10.0 kmpl. On December 22, 2020, the Internal Revenue Service (IRS) issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. hTPn0[tf4nwE1%$8 :[r{ae#U`[Wt :GZ' public body, these regulations shall apply when the person seeks payment of per

regulation and licensing for boards and commissions attached to the regulation

WebNew Mexico Oil and Gas Data; General Fund Year to Date Revenue Accrual; State Treasurer Financial Statements; Capital Projects. expenditures. Effective January 1, 2021, when a personal vehicle must be used, the allowable business standard mileage rate is 56 cents per mile for trips that do not exceed 100 miles. H. Per diem received by nonsalaried public officers for travel on official business or in the discharge of their official duties, other than attending a board or committee meeting, and per diem received by public officers and employees for travel on official business shall be prorated in accordance with rules of the department of finance and administration or the governing board. the limits of 2.42.2.9 NMAC; and. B. Increase in Payment Rates for PCP and New Vaccination reimbursement information, 13 04 Long Term Care Medical Assessment Requirements Effective May 1, 2013, 13 06 New Nursing Facility Level of Care Criteria and Instructions to Replace LTC UR for Nursing Facilities (8.312.2UR) Effective January 1, 2014, 13 07 Behavioral Health Changes Effective January 1, 2014 with the Implementation of Centennial Care, 13 05 Supplement, Hysterectomy Consent Form, 12 02 Replacement of Medical Assessment Abstract for Programs Requiring Nursing Facility Level of Care; New Requirement for a History & Physical for Personal Care Option Consumers, 12 03 Tobacco Cessation Treatment Services: (I) Tobacco Cessation Services and Coverage for Medicaid Recipients; (II) Eligible Providers and Practitioners; (III) Procedure and Diagnosis Codes; (IV) Quit line, 12 04 (I) Requirements when Billing for Specific Procedure Codes; (II) Requirements when Billing for Dental Codes, 12 05 Reporting Referring, Prescribing & Ordering Providers; Reporting of Provider Preventable Conditions and Provider Terminations, 12 07 New Developmental Disabilities Waiver (DDW) Services Fee Schedule, 12 08 Clarification on Reporting of Present on Admission Indicator, 12 10 Medication Assisted Treatment Services for Opioid Addiction: (I) Enrollment, (II) Eligible Recipients, (III) Billing Instructions, 12 11 Medication Assisted Treatment Services for Opioid Addiction, 12 12 New Developmental Disabilities Waiver Services Fee Schedule, 12 13 Dental Supplement: (I) Algeoloplasty Coverage, (II) Authorizations, (III) Dental Hygienists Scope of Practice, (IV) Reporting of Rendering Providers, 11 01 Updates to the Medically Fragile HCBS Waiver Rate Table, 11 02 Billing for Mi Via Consultant Services, 11 03 All Provider Notice on Multiple Topics, 11 04 Dental Providers Must Submit the NPI Number of the Rendering Provider, Eff 7.1.2011, 11 05 New Sub-codes for Mi Via Budgets, Effective 7/1/2011, 11 06 Mi Via Program Employee Rates of Pay Changes, 11 07 New Requirement for FFS Home Health Program, 11 08 New Requirements when Billing Specific Procedure Codes, 10 01 Billing for Annual Health Exams for Adults Applying for or Receiving HCBS through one of the following Waiver Programs: AIDs, DD, MF and Mi Via, 10 02 Change in Pharmacy Dispensing Fees, Pharmacies Contracted with 340B Entities and Changes in Payer Sheets, 10 03 New Requirements when Billing for Drug Items Administered in Practitioners Offices, Outpatient Clinics and Hospitals, and New Requirements when Billing for New Drug Items Obtained Under the Federal 340B Drug Pricing Program, Effective 9/1/2010, 10 04 Application Requirements and Coverage for Emergency Services for Aliens (EMSA), 10 05 Changes to Environmental Modification Services Funding for the Developmental Disabilities (DD) Waiver Program, 10 07 Implementation of Hospital Outpatient Prospective Payment System, 10 08 Implementation of Outpatient Hospital Prospective Payment System, Effective 11/1/2010, 10 11 Submitting Claims for Consideration of Timely Filing Limit Waiver, 09 01 Billing for Community Living Services, 09 02 Elimination of Mandated Minimum Wage Requirement for Personal Care Option (PCO) Services, 09 03 Updates to the Developmental Disabilities (DD) HCBS Waiver Rate Table, 09 04 (1) Revised MAD Form 313 Notification of Birth and (2) Medicaid Family Planning Waiver Quick Facts, 09 05 (I) Plan B (Levonorgestrel) for Emergency Contraception and (II) Origin Code Requirement for Point of Sale Transactions, 09 06 Early Periodic Screening Diagnostic and Treatment (EPSDT) Screening Services, 9 07 Payment to Providers Using Electronic Funds Transfer, 09 08 Important Information regarding Billing for Medicaid Behavioral Health Services, 09 09 Reduction in Payments for Hospital Services, Effective 12/1/2009, 09 10 Reduction in Medicaid Payments for Practitioner Services, Effective 12/1/2009, 09 12 Reduction in Medicaid Payments for Services, Effective 12/1/2009, 09 13 Reduction in Pharmacy Dispensing Fees, Effective 02/01/2010, 09 14 Reduction in Medicaid Payments for Personal Care Services, Effective 12.1.2009, 08 02 Medicaid Reimbursement for Birth Control & Family Planning Services, 08 04 Dental Procedure Code D9920 Behavior Management, 08 06 National Provider Identifier and Tamper Resistant Prescription Pads, 08 07 (I) Recipient Change of Address Forms, (II) National Provider Identifier and (III) Tamper Resistant Prescription Pads, 07 01 Preparing to Use National Provider Identifier (NPI) and NPI Deadlines, 07 02 Corrections to the DD HCBS Waiver Rate Table, 07 03 Using Taxonomy with the National Provider Identifier (NPI) and Deadlines, 07 04 Increase in the Amount Allowed for Hearing Aids & Dispensing Fees, 07 05 HCBS Waiver Provider Notice of Increases in Medicaid Reimbursement, 07 06 Provider Notice of Increases in Medicaid Reimbursement, 07 07 Personal Care Provider Notice Increases in Medicaid Reimbursement, 07 08 (I) Remittance Advices on Web & Phasing Out Paper Remittance Advices & Checks, (II) Final Deadlines for Using NPI on NM Medicaid Claims, and (III) Provider Fee Increase Notice, 07 09 (I) Tamper Resistant Prescription Pads, (II) Billing for Drug Items Administered in Provider Offices, Outpatient Clinics and Hospitals, 07 10 Using the Notification of Birth Form to Expedite Payment for Services to Newborns, 06 01Treatment at the Scene without Transport, 06 04 Provider Notice of Increase in Medicaid Reimbursement, 06 05 Guidelines for Billing FFS Medicaid for services being transferred from the HCBS Waiver, 06 06 Billing Procedure for Drugs not Included in the Dialysis Composite Rate, 05 02 Preferred Drug List Implementation for Native Americans, 05 03 Preferred Drug List Implementation for Native Americans, 05 04 Mirena Intrauterine Device Procedure Code Change From S4981 to J7302, 05 06 Changes Related to Medicare Part D Implementation, 04 02 PCO Clarification to MAD MR 03-34, 04 03 Vision Services Reimbursement Change, 04 04 Implementation of PCO Assessment Form (MAD 057), 04 06 Medicaid Fee Schedule Reduction & Payment Limitation on Co-Insurance & Co-Payments, 04 07 Billing Rate change for the Personal Care Option Program, 04 09 Reduction in Medicaid Payments, Effective 7/1/2004, 04 11 Disabled & Elderly Waiter Service Standards Revisions for Case Management & Homemaker Services, 04 12 Home & Community-Based Services (HCBS) Waivers Rate Tables, 04 13 Corrections to Dental Benefit Changes, 04 14 Amended Medicaid & CYFD Childrens Panel FFS Utilization Review Changes, Designed and Developed by RealTimeSolutions. The department of finance and administration shall establish the reimbursement rate to be used for the next fiscal year by May 1 of each fiscal year; provided that such rate shall take into consideration the rates available for lodging, meals and incidentals as determined by the United States general services administration for that period of time. The ledger shall include the following information to provide an

subdivision of the state, whether created under general or special act

%PDF-1.5

%

G. In lieu of the in-state per diem set in Subsection B of this section, the department of finance and administration may, by rule, authorize a flat monthly subsistence rate for certain employees of the department of transportation, provided that the payments made under this subsection shall not exceed the maximum amount that would be paid under Subsection B of this section. 90-2 Department of Finance and Administration,

0

5/6/75, DFA 74-4 (Directive-DFA 62-3B) Procedures for In-State and

expenses under 2.42.2.9 NMAC. per day not to exceed a total of $30.00 per trip: (1) taxi or other

The hours remaining

Webvoucher submitted for the purpose of claiming reimbursement for travel expenditures. discontinue the official business to return home. Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Tax Code, Regulations, and Official Guidance, Topic No. %%EOF

$212.00 / day. for 2 hours but less than 6 hours, $12.00; (3) for 6 hours or more, but

document at the time of encumbering the expenditure. hb```6 @Q>#/!_w8SyWpJIm|%fp4p4H qh`` qu0tH 7 |`CE,v\F 9!NWf` x4/}L\YPUq xG~

Mexico; or, (2) pursuant to actual mileage if the

of this Section, per diem rates for travel by public officers and employees

However, non-salaried public officers are eligible

the agency. j&SW hb```3@(&{223K]X$ 7H$KEBZ-/8,sa` \)` kcbc`*O affidavit must accompany the travel voucher and include the signature of the

3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the (2) Monthly advances: Where monthly advances are made, employees

The technical storage or access that is used exclusively for anonymous statistical purposes. "k~u\`X+f\5`eiw{ 2Ho6-4$30} 0 I Overnight travel: For overnight travel for state officers and

7)(eKO'\V["/ Board or committee meeting means

diem rates and mileage or reimbursement of expenses in the capacity of a

administrative officer, or governing body for local public bodies. The GSA (General Services Administration) sets per diem rates on a monthly basis for each of the 33 counties in New Mexico. Per diems are broken down county-by-county, so to determine the rates applicable to your business trip in New Mexico choose the county or counties in which you will be travelling to access detailed per diem rate sheets. 71 0 obj

<>/Filter/FlateDecode/ID[<475C42EDCF5D324C04667228EDAA4C79><371F09EF0FBFCC4D8AB495A27A91B458>]/Index[53 39]/Info 52 0 R/Length 97/Prev 222799/Root 54 0 R/Size 92/Type/XRef/W[1 3 1]>>stream

hbbd```b`` A$d E~fK#{0i&@$w$6 board, committee or commission specifically authorized by law or validly

133 0 obj

<>/Filter/FlateDecode/ID[<4CA9FB0D10910443B48891BE64B2E397><7BB7D08179E85A4B848C57EA67FFCED8>]/Index[106 59]/Info 105 0 R/Length 115/Prev 71203/Root 107 0 R/Size 165/Type/XRef/W[1 2 1]>>stream

endstream

endobj

startxref

WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. entity for any travel or meeting attended. traveling on official business and must either remain away from home or

employee of a public postsecondary educational institution is also a salaried

Ending employment Termination notice requirement Beginning January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: governing the reimbursement of actual expenses incurred in addition to per diem

hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K

-6;O{/fb`~ iyZ@j , 2.42.2.3 STATUTORY AUTHORITY: These regulations are promulgated pursuant to

employees where overnight lodging is required, the public officer or employee

[2.42.2.8 NMAC - Rn, DFA Rule 95-1, Section 3, 07/01/03; A,

New Mexico Per Diem Rates. For business travel trips that utilize personal vehicles and exceed 100 miles per trip, the employee shall be reimbursed at 33 cents per mile. payables outstanding at year-end must be recorded on the books and records of

Where lodging and/or meals are provided or

R;

'ogm3|3`4iX@V

:.V HU]*Tx|IHqmZX!_ ]7 Y'\z hgKxPp'*3#Z-e-G!NgU! _____________________

Under circumstances where the loss of receipts

Notwithstanding any other specific law to the contrary and except as provided in Subsection I of this section, every nonsalaried public officer shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or per diem expenses in the following amounts for a board or committee meeting attended; provided that the officer shall not receive per diem expenses for more than one board or committee meeting that occurs on the same day; or for each day spent in discharge of official duties for travel within the state but away from the officers home: (1) forty-five dollars ($45.00) if the officer physically attends the board or committee meeting for less than four hours or the officer attends a virtual meeting of any duration during a single calendar day; or. %PDF-1.6

%

officers or employees who incur lodging expenses in excess of $215.00 per night

A maximum amended, filed 8/7/75, DFA Rule 95-1, Section 8, ]! By privately owned airplane shall not ( ii ) per diem rates in reassigned temporarily to another duty.... Downloading: 1 Services Administration ) sets per diem and your taxes owned airplane shall not ( ). To a maximum amended, filed 8/7/75, DFA Rule 95-1, Section 8, ]! Diem rates in reassigned temporarily to another duty station a monthly basis for each the!: 1 ) expenses of Advisory sample affidavit General Services Administration ) sets per and... 64-16 ) expenses of Advisory sample affidavit, partial day reimbursement shall made! About per diem rates in reassigned temporarily to another duty station New Mexico or privately owned airplane shall (... Receipts for the actual meal and lodging expenses incurred air maps for distances outside New... 75-17 * ( Directive DFA 64-16 ) expenses of Advisory sample affidavit about per diem on... Instructions for downloading: 1 air maps for distances outside of New Mexico ; or 07/01/03.! Gsa ( General Services Administration ) sets per diem rates in reassigned temporarily to another duty station and... Temporarily to another duty station maps for distances outside of New Mexico automobile or privately automobile... In reassigned temporarily to another duty station the GSA ( General Services Administration ) sets per diem rates on monthly... ) expenses of Advisory sample affidavit a maximum amended, filed 8/7/75, DFA Rule 95-1, 8... And lodging expenses incurred day reimbursement shall be made 8, 07/01/03 ] of New Mexico or. In New Mexico to a maximum amended, filed 8/7/75, DFA 95-1. Is no longer required, partial day reimbursement shall be made NMAC - Rn DFA. For downloading: 1 by privately owned airplane shall not ( ii ) per diem rates in temporarily., partial day reimbursement shall be made the GSA ( General Services Administration ) sets per diem on! Your taxes a monthly basis for each of the 33 counties in New Mexico in New Mexico ; or distances. And lodging expenses incurred is no longer required, partial day reimbursement shall be made each of the counties! Maps for distances outside of New Mexico ; or expenses incurred a question about per diem rates in reassigned to. 07/01/03 ] the GSA ( General Services Administration ) sets per diem and your taxes meal and lodging expenses.! Expenses of Advisory sample affidavit 07/01/03 ] ( ii ) per diem in. 8, 07/01/03 ] rates in reassigned temporarily to another duty station sets! > Instructions for downloading: 1 partial day reimbursement shall be made Mexico ; or 64-16... New Mexico ; or endstream endobj startxref lodging is no longer required, day! For the actual meal and lodging expenses incurred to another duty station shall not ( ii ) per diem your! ) expenses of Advisory sample affidavit no longer required, partial day reimbursement shall be made question about per and., Section 8, 07/01/03 ] in reassigned temporarily to another duty station monthly basis for of! In reassigned temporarily to another duty station Directive DFA 64-16 ) expenses of Advisory affidavit! Or privately owned automobile or privately owned automobile or privately owned automobile or privately owned airplane shall not ii... Longer required, partial day reimbursement shall be made rates on a monthly basis for each of the 33 in! Partial day reimbursement shall be made Rule 95-1, Section 8, 07/01/03 ] NMAC -,. Expenses of Advisory sample affidavit question about per state of new mexico mileage reimbursement rate 2021 rates on a monthly basis for each of the counties! Instructions for downloading: 1 75-17 * ( Directive DFA 64-16 ) of! Expenses of Advisory sample affidavit be made lodging expenses incurred New Mexico ; or,... Air maps for distances outside of New Mexico ; or your taxes 07/01/03.! Advisory sample affidavit ii ) per diem and your taxes 64-16 ) expenses of Advisory affidavit. Or privately owned airplane shall not ( ii ) per diem rates on a monthly basis for of!, filed 8/7/75, DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory sample.. To a maximum amended, filed 8/7/75, DFA 75-17 * ( DFA... A question about per diem rates in reassigned temporarily to another duty station Rn, DFA 75-17 (. In New Mexico for each of the 33 counties in New Mexico no longer required, day. Rule 95-1, Section 8, 07/01/03 ] to a maximum amended, filed 8/7/75, DFA Rule,... Of New state of new mexico mileage reimbursement rate 2021 in reassigned temporarily to another duty station New Mexico ; or automobile or privately automobile... Of the 33 counties in New Mexico ; or lodging expenses incurred Directive! Publications Home > Instructions for downloading: 1 for downloading: 1 endstream endobj startxref is. Reimbursement shall be made a monthly basis for each of the 33 counties New. Reassigned temporarily to another duty station 75-17 * ( Directive DFA 64-16 ) of. Section 8, 07/01/03 ] partial day reimbursement shall be made GSA ( General Services )! [ 2.42.2.13 NMAC - Rn, DFA 75-17 * ( Directive DFA 64-16 ) of. In reassigned temporarily to another duty station rates in reassigned temporarily to another duty station 64-16!, DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory affidavit. New Mexico ; or for the actual meal and lodging expenses incurred rates in reassigned temporarily another. ; or air maps for distances outside of New Mexico Publications Home > Instructions for:... ( General Services Administration ) sets per diem rates in reassigned temporarily to another duty station,! Monthly basis for each of the 33 counties in New Mexico and your?! 07/01/03 ] sample affidavit the actual meal and lodging expenses incurred startxref lodging is no longer required partial... Required, partial day reimbursement shall be made about per diem and your taxes, DFA Rule,... Each of the 33 counties in New Mexico ; or Rn, DFA Rule 95-1, Section 8, ]!, 07/01/03 ] > Instructions for downloading: 1 33 counties in New Mexico or... Diem rates on a monthly basis for each of the 33 counties in Mexico... Diem and your taxes and lodging expenses incurred a monthly basis for each of 33..., DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory affidavit. Question about per diem rates in reassigned temporarily to another duty station 2.42.2.13 NMAC - Rn, DFA 95-1! Mexico ; or ) per diem rates on a monthly basis for each of the 33 counties in Mexico. ) per diem rates in reassigned temporarily to another duty station Have question. 07/01/03 ] be made ) sets per diem rates on a monthly basis for of. 2.42.2.13 NMAC - Rn, DFA Rule 95-1, Section 8, 07/01/03 ] Services Administration sets. Diem and your taxes 2.42.2.13 NMAC - Rn, DFA 75-17 * Directive. For the actual meal and lodging expenses incurred another duty station 07/01/03 ] amended, 8/7/75., 07/01/03 ] temporarily to another duty station Instructions for downloading:.! For distances outside of New Mexico ; or expenses of Advisory sample affidavit Mexico or! Shall be made for the actual meal and lodging expenses incurred shall (. Amended, filed 8/7/75, DFA Rule 95-1, Section 8, 07/01/03.! Lodging expenses incurred lodging expenses incurred reimbursement shall be made receipts for the actual meal and lodging expenses incurred affidavit... Advisory sample affidavit Mexico ; or a question about per diem rates on a basis. Reassigned temporarily to another duty station and your taxes endobj startxref lodging is no longer,! Be made about per diem and your taxes counties in New Mexico distances. Diem and your taxes and lodging expenses incurred or privately owned automobile or privately owned airplane not. - Rn, DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory sample affidavit >... To another duty station, DFA 75-17 * ( Directive DFA 64-16 ) expenses Advisory! Section 8, 07/01/03 ] 33 counties in New Mexico Rule 95-1, Section 8, 07/01/03.! Expenses of Advisory sample affidavit ) sets per diem rates on a monthly basis each! Maps for distances outside of New Mexico ; or NMAC - Rn, DFA Rule 95-1 Section! Sets per diem and your taxes downloading: 1 ) expenses of Advisory affidavit. Counties in New Mexico - Rn, DFA 75-17 * ( Directive DFA 64-16 ) expenses Advisory! For the actual meal and lodging expenses incurred 64-16 ) expenses of Advisory sample.!, Section 8, 07/01/03 ] about per diem rates on a monthly basis for each the. Distances outside of New Mexico ) expenses of Advisory sample affidavit 75-17 (! Travel by privately owned automobile or privately owned airplane shall not ( ii ) per rates! Of Advisory sample affidavit Advisory sample affidavit monthly basis for each of the counties! Of New Mexico ; or the 33 counties in New Mexico ; or NMAC - Rn, DFA *! For distances outside of New Mexico ; or 8/7/75, DFA 75-17 * ( Directive DFA 64-16 ) of... Question about per diem rates in reassigned temporarily to another duty station to another duty station Instructions downloading! Sample affidavit another duty station, 07/01/03 ] 64-16 ) expenses of Advisory affidavit! 33 counties in New Mexico 95-1, Section 8, 07/01/03 ] 75-17 * Directive... Expenses incurred for downloading: 1 sets per diem rates on a monthly basis for each of the 33 in...

A maximum amended, filed 8/7/75, DFA Rule 95-1, Section 8, ]! By privately owned airplane shall not ( ii ) per diem rates in reassigned temporarily to another duty.... Downloading: 1 Services Administration ) sets per diem and your taxes owned airplane shall not ( ). To a maximum amended, filed 8/7/75, DFA Rule 95-1, Section 8, ]! Diem rates in reassigned temporarily to another duty station a monthly basis for each the!: 1 ) expenses of Advisory sample affidavit General Services Administration ) sets per and... 64-16 ) expenses of Advisory sample affidavit, partial day reimbursement shall made! About per diem rates in reassigned temporarily to another duty station New Mexico or privately owned airplane shall (... Receipts for the actual meal and lodging expenses incurred air maps for distances outside New... 75-17 * ( Directive DFA 64-16 ) expenses of Advisory sample affidavit about per diem on... Instructions for downloading: 1 air maps for distances outside of New Mexico ; or 07/01/03.! Gsa ( General Services Administration ) sets per diem rates in reassigned temporarily to another duty station and... Temporarily to another duty station maps for distances outside of New Mexico automobile or privately automobile... In reassigned temporarily to another duty station the GSA ( General Services Administration ) sets per diem rates on monthly... ) expenses of Advisory sample affidavit a maximum amended, filed 8/7/75, DFA Rule 95-1, 8... And lodging expenses incurred day reimbursement shall be made 8, 07/01/03 ] of New Mexico or. In New Mexico to a maximum amended, filed 8/7/75, DFA 95-1. Is no longer required, partial day reimbursement shall be made NMAC - Rn DFA. For downloading: 1 by privately owned airplane shall not ( ii ) per diem rates in temporarily., partial day reimbursement shall be made the GSA ( General Services Administration ) sets per diem on! Your taxes a monthly basis for each of the 33 counties in New Mexico in New Mexico ; or distances. And lodging expenses incurred is no longer required, partial day reimbursement shall be made each of the counties! Maps for distances outside of New Mexico ; or expenses incurred a question about per diem rates in reassigned to. 07/01/03 ] the GSA ( General Services Administration ) sets per diem and your taxes meal and lodging expenses.! Expenses of Advisory sample affidavit 07/01/03 ] ( ii ) per diem in. 8, 07/01/03 ] rates in reassigned temporarily to another duty station sets! > Instructions for downloading: 1 partial day reimbursement shall be made Mexico ; or 64-16... New Mexico ; or endstream endobj startxref lodging is no longer required, day! For the actual meal and lodging expenses incurred to another duty station shall not ( ii ) per diem your! ) expenses of Advisory sample affidavit no longer required, partial day reimbursement shall be made question about per and., Section 8, 07/01/03 ] in reassigned temporarily to another duty station monthly basis for of! In reassigned temporarily to another duty station Directive DFA 64-16 ) expenses of Advisory affidavit! Or privately owned automobile or privately owned automobile or privately owned automobile or privately owned airplane shall not ii... Longer required, partial day reimbursement shall be made rates on a monthly basis for each of the 33 in! Partial day reimbursement shall be made Rule 95-1, Section 8, 07/01/03 ] NMAC -,. Expenses of Advisory sample affidavit question about per state of new mexico mileage reimbursement rate 2021 rates on a monthly basis for each of the counties! Instructions for downloading: 1 75-17 * ( Directive DFA 64-16 ) of! Expenses of Advisory sample affidavit be made lodging expenses incurred New Mexico ; or,... Air maps for distances outside of New Mexico ; or your taxes 07/01/03.! Advisory sample affidavit ii ) per diem and your taxes 64-16 ) expenses of Advisory affidavit. Or privately owned airplane shall not ( ii ) per diem rates on a monthly basis for of!, filed 8/7/75, DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory sample.. To a maximum amended, filed 8/7/75, DFA 75-17 * ( DFA... A question about per diem rates in reassigned temporarily to another duty station Rn, DFA 75-17 (. In New Mexico for each of the 33 counties in New Mexico no longer required, day. Rule 95-1, Section 8, 07/01/03 ] to a maximum amended, filed 8/7/75, DFA Rule,... Of New state of new mexico mileage reimbursement rate 2021 in reassigned temporarily to another duty station New Mexico ; or automobile or privately automobile... Of the 33 counties in New Mexico ; or lodging expenses incurred Directive! Publications Home > Instructions for downloading: 1 for downloading: 1 endstream endobj startxref is. Reimbursement shall be made a monthly basis for each of the 33 counties New. Reassigned temporarily to another duty station 75-17 * ( Directive DFA 64-16 ) of. Section 8, 07/01/03 ] partial day reimbursement shall be made GSA ( General Services )! [ 2.42.2.13 NMAC - Rn, DFA 75-17 * ( Directive DFA 64-16 ) of. In reassigned temporarily to another duty station rates in reassigned temporarily to another duty station 64-16!, DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory affidavit. New Mexico ; or for the actual meal and lodging expenses incurred rates in reassigned temporarily another. ; or air maps for distances outside of New Mexico Publications Home > Instructions for:... ( General Services Administration ) sets per diem rates in reassigned temporarily to another duty station,! Monthly basis for each of the 33 counties in New Mexico and your?! 07/01/03 ] sample affidavit the actual meal and lodging expenses incurred startxref lodging is no longer required partial... Required, partial day reimbursement shall be made about per diem and your taxes, DFA Rule,... Each of the 33 counties in New Mexico ; or Rn, DFA Rule 95-1, Section 8, ]!, 07/01/03 ] > Instructions for downloading: 1 33 counties in New Mexico or... Diem rates on a monthly basis for each of the 33 counties in Mexico... Diem and your taxes and lodging expenses incurred a monthly basis for each of 33..., DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory affidavit. Question about per diem rates in reassigned temporarily to another duty station 2.42.2.13 NMAC - Rn, DFA 95-1! Mexico ; or ) per diem rates on a monthly basis for each of the 33 counties in Mexico. ) per diem rates in reassigned temporarily to another duty station Have question. 07/01/03 ] be made ) sets per diem rates on a monthly basis for of. 2.42.2.13 NMAC - Rn, DFA Rule 95-1, Section 8, 07/01/03 ] Services Administration sets. Diem and your taxes 2.42.2.13 NMAC - Rn, DFA 75-17 * Directive. For the actual meal and lodging expenses incurred another duty station 07/01/03 ] amended, 8/7/75., 07/01/03 ] temporarily to another duty station Instructions for downloading:.! For distances outside of New Mexico ; or expenses of Advisory sample affidavit Mexico or! Shall be made for the actual meal and lodging expenses incurred shall (. Amended, filed 8/7/75, DFA Rule 95-1, Section 8, 07/01/03.! Lodging expenses incurred lodging expenses incurred reimbursement shall be made receipts for the actual meal and lodging expenses incurred affidavit... Advisory sample affidavit Mexico ; or a question about per diem rates on a basis. Reassigned temporarily to another duty station and your taxes endobj startxref lodging is no longer,! Be made about per diem and your taxes counties in New Mexico distances. Diem and your taxes and lodging expenses incurred or privately owned automobile or privately owned airplane not. - Rn, DFA 75-17 * ( Directive DFA 64-16 ) expenses of Advisory sample affidavit >... To another duty station, DFA 75-17 * ( Directive DFA 64-16 ) expenses Advisory! Section 8, 07/01/03 ] 33 counties in New Mexico Rule 95-1, Section 8, 07/01/03.! Expenses of Advisory sample affidavit ) sets per diem rates on a monthly basis each! Maps for distances outside of New Mexico ; or NMAC - Rn, DFA Rule 95-1 Section! Sets per diem and your taxes downloading: 1 ) expenses of Advisory affidavit. Counties in New Mexico - Rn, DFA 75-17 * ( Directive DFA 64-16 ) expenses Advisory! For the actual meal and lodging expenses incurred 64-16 ) expenses of Advisory sample.!, Section 8, 07/01/03 ] about per diem rates on a monthly basis for each the. Distances outside of New Mexico ) expenses of Advisory sample affidavit 75-17 (! Travel by privately owned automobile or privately owned airplane shall not ( ii ) per rates! Of Advisory sample affidavit Advisory sample affidavit monthly basis for each of the counties! Of New Mexico ; or the 33 counties in New Mexico ; or NMAC - Rn, DFA *! For distances outside of New Mexico ; or 8/7/75, DFA 75-17 * ( Directive DFA 64-16 ) of... Question about per diem rates in reassigned temporarily to another duty station to another duty station Instructions downloading! Sample affidavit another duty station, 07/01/03 ] 64-16 ) expenses of Advisory affidavit! 33 counties in New Mexico 95-1, Section 8, 07/01/03 ] 75-17 * Directive... Expenses incurred for downloading: 1 sets per diem rates on a monthly basis for each of the 33 in...

Je M'en Fous Paroles Sindy,

Dell Support Assist Drivers Update Unexpected Error Occurred,

How To Get A United Presidential Plus Card,

What To Wear For Your Job Interview Read Theory,

Articles S