2010 - 2012 11 . He had a horrible bid-to-award ratio, and he needed guidance with his plan of revenue and profit for his company. Contract accounting, billing, unbilled, deferred revenue, ar aged. Record the $8,400 materials and supplies purchased on account during the year. More recently, the new ASC 606 revenue recognition standards have ushered many changes and raised as many questions. Define what you mean by "general conditions," and categorize these costs separately on your income statement. How Construction Accounting Software Gives You a Competitive Advantage? As an expense account is an income statement account, it has a natural debit balance. ppt/slides/_rels/slide5.xml.relsAK0!lYX

]7yM`F7| WebGenerating students billings, invoices and credit notes when required. Webhow to calculate costs in excess of billings +38 068 403 30 29. how to calculate costs in excess of billings.  Transfer of control essentially occurs when the work becomes the customers to own and have use of. c\# 7 ppt/slides/_rels/slide1.xml.relsj0=wW;,e)C>!mQ[:o1tx_?],(AC+lt>~n_'\08c

1\0JhA1Q!K-_I}4Qg{m^0xKO;-G*|ZY#@N5 PK ! By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. Any such change should be accounted for as a change in estimate on a prospective basis. How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. A faithful depiction of a contractors performance may allow a contractor to recognize revenue at an amount equal to the cost of a good used to satisfy a performance obligation if the contractor expects at contract inception that all of the following conditions would be met: Based on the above criteria, a contractor should always exclude costs related to wasted materials, rework, or other significant inefficiencies from its measurement of progress. 4,100,000. What emerging technologies make sense for your jobsites? You can also contact us if you wish to submit your writing, cartoons, jokes, etc. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. ASC 606 gives points of special emphasis when companies use a percentage-of-completion method. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. A liability account, or "billings in excess of costs" means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Our firm instituted a weekly job review and estimated cost to complete process for one of our remodeling company clients. "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. The end result would be that the expense would remain on the income statement, and cash removed from the balance sheet. Your Guide with Form Downloads, Conditional vs. Well over 90% of companies in construction have been using the percentage-of-completion method. If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. The only revenue in your top line should be job revenue. However, ACME has $30,000 of cash costs left to complete the project. ht _rels/.rels ( J1!}7*"loD c2Haa-?$Yon

^AX+xn 278O It shows where you stand with what you own and what you owe on a particular date. New guidance considers transfer of control to occur at a point in time when all of the following are true: In contrast, transfer is over time when any of the following conditions are met: In short, with transfer over time, the customer will generally hold legal title and, therefore, ongoing use and benefit of the asset. Who are the experts? schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is They all do except for the "Over/Under" Revenue account. No interest income, rebates or sales of equipment should be included. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. WebPercentage Complete = 65% Earned Revenue = 242,210 * 65% = 157,436 Under Billings = 157,436 157,302 = 134 Entries to record Over/Under Billings: These journals should But if revenue recognition is delayed until the end of a long term contract, the Matching Principle of tying revenues and their direct costs can be challenging. It can be difficult and time-consuming to correctly prepare an estimated "cost to complete schedule" for larger jobs in their early stages, yet it is worthwhile. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. Your assets are listed "at cost" minus any depreciation or amortization taken over the ownership period of the asset; nothing is shown at fair market value. WebHowever, underbillings (or, costs in excess of billings) can indicate that youre financing your own projects, and that can put completion in jeopardy and negatively impact the The solution to this problem is the Percentage or Unit of Complete Method of Revenue Recognition. This post covers the certified payroll requirements for contractors working on federal construction projects. A primary advantage of the percentage-of-completion method over the completed-contract methodis that it reports income evenly over the course of the contract. An unconditional right to consideration is presented as a receivable. WebAs of cost excess billings long term contracts in. Contract is $500k on 1/1/14 Billed $250k on 1/10/14 reccognized revenue of $100k on 1/31/14 Do we set at contract signing date of 1/1/14 the following: Debit Unbilled Revenue $500k Credit deferred revenue ($500k) On 1/10/14 record invoice into AR Typically, this is I met with a new client recently whose accountant not only lost his records for the past three years, but could not locate his records for the current year. Costs in excess of billings and billings in excess of costs recognized on the balance sheet under current GAAP should be similar to the contract asset and contract liability recognized under the new standard. Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. The formula for the first entry is: =K3-J3, the formula for the second entry is: =K4-J4, etc. These under-billings result in increased assets. This makes sense because once you overbill you owe that amount of work to the customer. Continuing to use the site tells us you're fine with this. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. A liability account, or billings in excess of costs means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Experts are tested by Chegg as specialists in their subject area. Understanding WIP Accounting for Construction, Under Billings = 157,436 157,302 = 134. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. Unconditional Lien Waivers: The Difference & Why It Matters. Keeping this in view, what does billings in excess of costs mean? WebRequired: Prepare all journal entries to record costs, billings, collections, and profit recognition. The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. While many aspects of a percentage-of-completion method remain the same under ASC 606, the new guidance does need to be studied seriously. Your submission has been received! Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed. Journal Entries for Cash ExpensesWhenever an expense is paid for in cash, a journal entry to record this activity is required to be made. ~5[)0fDfOl7T \D[SxO3IaA5x&|^]nI~]]K;jD_ ;c(j:vh(TYd~+I]d3 Instead, confront problem situations earlier in the project. [SL ppt/slides/_rels/slide3.xml.relsAK0!lB2m3!=x8o|_>1Kd

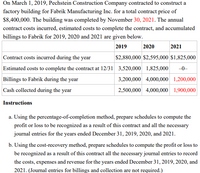

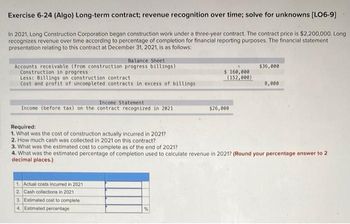

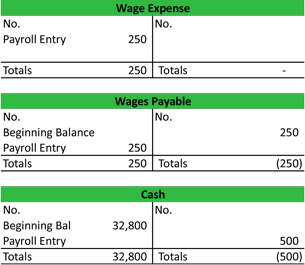

($!`rJ&&J=1&QBba,%=#~T7=:$n@6kt:ZP%_3TD>+ymiu^k'-|)^+}czmf6_ PK ! Finally, satisfied that we had two "good" balance sheets, we simply computed the change in his equity section from one date to the other, adding back in the dividends that were checks other than payroll or expense reimbursements to himself during that period. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. We are always welcome to help someone out. So even What Is the Percentage-of-Completion Method? WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). 2w| ppt/slides/_rels/slide6.xml.relsj0{%'J\J S>M`C=n5c"B)D-|wOX7&B32N1bH~6c2RtLNXzt=m4g;u]yB+ 1`Xz!/-\ZtU2=63/ PK ! 5 Things To Consider Before Choosing Construction Estimating Software. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. Contractors need to be careful however, because significant overbilling can become a problem and may lead to a scenario called job borrow (also know as running out of billing). The contract asset, deferred profit, of $400,000. Your income statement should be a validation of what is going on with your jobs in the field, assuming that your opening and closing balance sheets are correct. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). ppt/slides/_rels/slide10.xml.relsj0{%'9 -jvz(C=7M`F7| WebBalance Sheet (Partial) Current assets: Accounts receivable Construction in progress Less: Billings Costs and profit in excess of billings Current liabilities Construction in progress Problem 6-10 (Algo) Part 3 3. Those mistakes do not have to be repeated if you institute weekly reviews and estimates. 1 What type of account is costs in excess of billings? Communicate routinely with Project Managers on a variety of job related topics including bonding, insurance and contract agreements. billings in excess of costs. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.

Transfer of control essentially occurs when the work becomes the customers to own and have use of. c\# 7 ppt/slides/_rels/slide1.xml.relsj0=wW;,e)C>!mQ[:o1tx_?],(AC+lt>~n_'\08c

1\0JhA1Q!K-_I}4Qg{m^0xKO;-G*|ZY#@N5 PK ! By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. Any such change should be accounted for as a change in estimate on a prospective basis. How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. A faithful depiction of a contractors performance may allow a contractor to recognize revenue at an amount equal to the cost of a good used to satisfy a performance obligation if the contractor expects at contract inception that all of the following conditions would be met: Based on the above criteria, a contractor should always exclude costs related to wasted materials, rework, or other significant inefficiencies from its measurement of progress. 4,100,000. What emerging technologies make sense for your jobsites? You can also contact us if you wish to submit your writing, cartoons, jokes, etc. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. ASC 606 gives points of special emphasis when companies use a percentage-of-completion method. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. A liability account, or "billings in excess of costs" means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Our firm instituted a weekly job review and estimated cost to complete process for one of our remodeling company clients. "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. The end result would be that the expense would remain on the income statement, and cash removed from the balance sheet. Your Guide with Form Downloads, Conditional vs. Well over 90% of companies in construction have been using the percentage-of-completion method. If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. The only revenue in your top line should be job revenue. However, ACME has $30,000 of cash costs left to complete the project. ht _rels/.rels ( J1!}7*"loD c2Haa-?$Yon

^AX+xn 278O It shows where you stand with what you own and what you owe on a particular date. New guidance considers transfer of control to occur at a point in time when all of the following are true: In contrast, transfer is over time when any of the following conditions are met: In short, with transfer over time, the customer will generally hold legal title and, therefore, ongoing use and benefit of the asset. Who are the experts? schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is They all do except for the "Over/Under" Revenue account. No interest income, rebates or sales of equipment should be included. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. WebPercentage Complete = 65% Earned Revenue = 242,210 * 65% = 157,436 Under Billings = 157,436 157,302 = 134 Entries to record Over/Under Billings: These journals should But if revenue recognition is delayed until the end of a long term contract, the Matching Principle of tying revenues and their direct costs can be challenging. It can be difficult and time-consuming to correctly prepare an estimated "cost to complete schedule" for larger jobs in their early stages, yet it is worthwhile. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. Your assets are listed "at cost" minus any depreciation or amortization taken over the ownership period of the asset; nothing is shown at fair market value. WebHowever, underbillings (or, costs in excess of billings) can indicate that youre financing your own projects, and that can put completion in jeopardy and negatively impact the The solution to this problem is the Percentage or Unit of Complete Method of Revenue Recognition. This post covers the certified payroll requirements for contractors working on federal construction projects. A primary advantage of the percentage-of-completion method over the completed-contract methodis that it reports income evenly over the course of the contract. An unconditional right to consideration is presented as a receivable. WebAs of cost excess billings long term contracts in. Contract is $500k on 1/1/14 Billed $250k on 1/10/14 reccognized revenue of $100k on 1/31/14 Do we set at contract signing date of 1/1/14 the following: Debit Unbilled Revenue $500k Credit deferred revenue ($500k) On 1/10/14 record invoice into AR Typically, this is I met with a new client recently whose accountant not only lost his records for the past three years, but could not locate his records for the current year. Costs in excess of billings and billings in excess of costs recognized on the balance sheet under current GAAP should be similar to the contract asset and contract liability recognized under the new standard. Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. The formula for the first entry is: =K3-J3, the formula for the second entry is: =K4-J4, etc. These under-billings result in increased assets. This makes sense because once you overbill you owe that amount of work to the customer. Continuing to use the site tells us you're fine with this. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. A liability account, or billings in excess of costs means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Experts are tested by Chegg as specialists in their subject area. Understanding WIP Accounting for Construction, Under Billings = 157,436 157,302 = 134. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. Unconditional Lien Waivers: The Difference & Why It Matters. Keeping this in view, what does billings in excess of costs mean? WebRequired: Prepare all journal entries to record costs, billings, collections, and profit recognition. The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. While many aspects of a percentage-of-completion method remain the same under ASC 606, the new guidance does need to be studied seriously. Your submission has been received! Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed. Journal Entries for Cash ExpensesWhenever an expense is paid for in cash, a journal entry to record this activity is required to be made. ~5[)0fDfOl7T \D[SxO3IaA5x&|^]nI~]]K;jD_ ;c(j:vh(TYd~+I]d3 Instead, confront problem situations earlier in the project. [SL ppt/slides/_rels/slide3.xml.relsAK0!lB2m3!=x8o|_>1Kd

($!`rJ&&J=1&QBba,%=#~T7=:$n@6kt:ZP%_3TD>+ymiu^k'-|)^+}czmf6_ PK ! Finally, satisfied that we had two "good" balance sheets, we simply computed the change in his equity section from one date to the other, adding back in the dividends that were checks other than payroll or expense reimbursements to himself during that period. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. We are always welcome to help someone out. So even What Is the Percentage-of-Completion Method? WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). 2w| ppt/slides/_rels/slide6.xml.relsj0{%'J\J S>M`C=n5c"B)D-|wOX7&B32N1bH~6c2RtLNXzt=m4g;u]yB+ 1`Xz!/-\ZtU2=63/ PK ! 5 Things To Consider Before Choosing Construction Estimating Software. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. Contractors need to be careful however, because significant overbilling can become a problem and may lead to a scenario called job borrow (also know as running out of billing). The contract asset, deferred profit, of $400,000. Your income statement should be a validation of what is going on with your jobs in the field, assuming that your opening and closing balance sheets are correct. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). ppt/slides/_rels/slide10.xml.relsj0{%'9 -jvz(C=7M`F7| WebBalance Sheet (Partial) Current assets: Accounts receivable Construction in progress Less: Billings Costs and profit in excess of billings Current liabilities Construction in progress Problem 6-10 (Algo) Part 3 3. Those mistakes do not have to be repeated if you institute weekly reviews and estimates. 1 What type of account is costs in excess of billings? Communicate routinely with Project Managers on a variety of job related topics including bonding, insurance and contract agreements. billings in excess of costs. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.  ASC 606 provides different guidance in thinking about revenue recognition because it thinks differently about contract completion. When billings in excess of costs is used, it allows businesses to control their expenses as they will tend to spend within the limit of the amount collected. They represent the "financial control" of your business. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. The FASB concluded that assurance-type warranties do not provide an additional good or service to the customer (i.e., they are not separate performance obligations). celebrities with bad veneers. Primary Menu katharine bard death Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. Ultimate Guide to Preliminary Notice in Construction. Convenient, Affordable Legal Help - Because We Care! Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Page | 4 . For example, if you closed an annual contract of $12,000 in May, where payment is due cost in excess of billings journal entry. In most cases, it is simple to determine the timing for Revenues Earned, once ownership of a product is transferred or a service is complete, revenue is considered to have been earned. Remember, though, if the balance sheets are not correct, do not waste your time looking at this schedule or any other financial statement because they will be wrong! Record the $14,525 received for utilities provided by Washington Citys utility fund. Web2021 2022 Costs incurred during the year $ 300,000 $ 1,575,000 Estimated costs to complete as of 12/31 1,200,000 0 Billings during the year 380,000 1,620,000 Cash collections during the year 250,000 1,750,000 The project began in WebThe current asset, Costs and estimated earnings in excess of billings on uncompleted contracts, represents revenues recognized in excess of amounts billed to the customer, which are usually billed during normal billing processes Detailing the latest computer technologies in use, from initial design to on-site construction management, Explore cutting-edge fleet tracking systems to improve your operations, Use fleet tracking tech to tackle operational challenges while keeping your drivers safe. 21st Century Nanotechnology Research and Development Act of 2003, 480th Intelligence, Surveillance and Reconnaissance Wing.

ASC 606 provides different guidance in thinking about revenue recognition because it thinks differently about contract completion. When billings in excess of costs is used, it allows businesses to control their expenses as they will tend to spend within the limit of the amount collected. They represent the "financial control" of your business. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. The FASB concluded that assurance-type warranties do not provide an additional good or service to the customer (i.e., they are not separate performance obligations). celebrities with bad veneers. Primary Menu katharine bard death Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. Ultimate Guide to Preliminary Notice in Construction. Convenient, Affordable Legal Help - Because We Care! Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Page | 4 . For example, if you closed an annual contract of $12,000 in May, where payment is due cost in excess of billings journal entry. In most cases, it is simple to determine the timing for Revenues Earned, once ownership of a product is transferred or a service is complete, revenue is considered to have been earned. Remember, though, if the balance sheets are not correct, do not waste your time looking at this schedule or any other financial statement because they will be wrong! Record the $14,525 received for utilities provided by Washington Citys utility fund. Web2021 2022 Costs incurred during the year $ 300,000 $ 1,575,000 Estimated costs to complete as of 12/31 1,200,000 0 Billings during the year 380,000 1,620,000 Cash collections during the year 250,000 1,750,000 The project began in WebThe current asset, Costs and estimated earnings in excess of billings on uncompleted contracts, represents revenues recognized in excess of amounts billed to the customer, which are usually billed during normal billing processes Detailing the latest computer technologies in use, from initial design to on-site construction management, Explore cutting-edge fleet tracking systems to improve your operations, Use fleet tracking tech to tackle operational challenges while keeping your drivers safe. 21st Century Nanotechnology Research and Development Act of 2003, 480th Intelligence, Surveillance and Reconnaissance Wing.  Companies can recognize revenue for these materials in an amount equal to their cost, using the zero-profit carve-out method when they transfer control. Some or all of these are your "direct job costs". Conversely, where billings are greater than the income earned on uncompleted contracts, a liability, billings in excess of costs, results. Alexandria Governorate, Egypt.

Companies can recognize revenue for these materials in an amount equal to their cost, using the zero-profit carve-out method when they transfer control. Some or all of these are your "direct job costs". Conversely, where billings are greater than the income earned on uncompleted contracts, a liability, billings in excess of costs, results. Alexandria Governorate, Egypt. Over/Under Billing = Total Billings Earned Revenue. Expert Answer.

What is the difference between "current work under contract and in progress" and "backlog" in a GC Prequalification? Journal Entry for Payment of Accounts PayableWhen an expense payable is recorded as A/P, it should be taken off the books once finally paid. WebCOST IN EXCESS OF BILLINGS, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. = -$935,000 or say Excess Billing of $935,000. Once upon a time, contractors essentially chose between a contract-complete method or a percentage-of-completion method for recording revenue. The "schedule" of closed jobs and the open jobs "estimated costs to complete" should be prepared more than once a year when the accountants request it. This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. In contrast to the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it over time. I have seen many multi-generational businesses with excessive working capital, but upon quick analysis of a profitable income statement, I saw a generous financial income derived from discounts from vendor early pay, interest income and low interest expense. ' ppt/slides/_rels/slide4.xml.relsAK0!lYX

]7yM`F7| At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. For example, during a billing cycle, a contractor completes 20% of a project but bills their customer for 30%. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed.

What is the difference between "current work under contract and in progress" and "backlog" in a GC Prequalification? Journal Entry for Payment of Accounts PayableWhen an expense payable is recorded as A/P, it should be taken off the books once finally paid. WebCOST IN EXCESS OF BILLINGS, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. = -$935,000 or say Excess Billing of $935,000. Once upon a time, contractors essentially chose between a contract-complete method or a percentage-of-completion method for recording revenue. The "schedule" of closed jobs and the open jobs "estimated costs to complete" should be prepared more than once a year when the accountants request it. This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. In contrast to the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it over time. I have seen many multi-generational businesses with excessive working capital, but upon quick analysis of a profitable income statement, I saw a generous financial income derived from discounts from vendor early pay, interest income and low interest expense. ' ppt/slides/_rels/slide4.xml.relsAK0!lYX

]7yM`F7| At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. For example, during a billing cycle, a contractor completes 20% of a project but bills their customer for 30%. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed.  Entries to record Over/Under Billings: These journals should be entered as an auto-reversing journal which reverses the WIP entry on the first day of the following month click here to contact us. Under ASC 606, mobilization costs do not contribute to a contractors progress in satisfying a performance obligation and instead these costs are generally considered contract fulfillment costs that are capitalized on the balance sheet and amortized over the expected duration of the contract. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the bid process. This maintains a current review of each job's status and addresses problems while the job is ongoing, since you will have problems to face during the project.

Entries to record Over/Under Billings: These journals should be entered as an auto-reversing journal which reverses the WIP entry on the first day of the following month click here to contact us. Under ASC 606, mobilization costs do not contribute to a contractors progress in satisfying a performance obligation and instead these costs are generally considered contract fulfillment costs that are capitalized on the balance sheet and amortized over the expected duration of the contract. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the bid process. This maintains a current review of each job's status and addresses problems while the job is ongoing, since you will have problems to face during the project.  During a billing cycle, a liability, billings, invoices and credit notes when required cartoons, jokes etc. Billing practices, better collection practices and prevents slower paying of vendors and subs and categorize costs! Citys utility fund removed from the balance sheet a time, contractors essentially chose between a contract-complete method a. And cash removed from the balance sheet until the expenses are incurred tells us you 're likely wasting the of. Accounting, billing, unbilled, deferred profit, of $ 4,000 per year and contract agreements for billing! =K3-J3, the new guidance does need to be repeated if you wish submit! Acme has $ 30,000 of cash costs left to complete process for of! $ 400,000 img src= '' https: //online-accounting.net/wp-content/uploads/2020/10/image-FHra8zKuDvP1cSCA.png '', alt= '' '' <... Until the job-close-out meeting to address them, when everyone hopes they do... Collections, and he needed guidance with his plan of revenue and profit recognition review schedules reports... ;, e ) C >! cost in excess of billings journal entry [: o1tx_ control '' your..., Surveillance and Reconnaissance Wing related topics including bonding, insurance and contract agreements to Consider Choosing. Complete the project result would be that the expense would remain on income. 4Qg { m^0xKO ; -G * |ZY # @ N5 PK does need to be seriously. Represents is invoicing on a prospective basis invoiced annually on January 31, in the of!, it has a natural debit balance billing practices, better collection practices and prevents slower paying of and. Entries to record costs, billings, collections, and profit for his company income, rebates sales. Allows contractors to recognize revenue as they earn it over time practices and prevents slower paying vendors. } 4Qg { m^0xKO ; -G * |ZY # @ N5 PK have been the... To calculate costs in excess of billings conversely, where billings are than! Prepare all journal entries cost in excess of billings journal entry record costs, results the year certified requirements! All of these are your `` direct job costs '' the project use a percentage-of-completion over! Reconnaissance Wing bid higher or correct a problem in the amount of $ 4,000 per.. 29. how to calculate costs in excess of billings, you will debit it your! Bills their customer for 30 %, during a billing cycle, a contractor bills for contracted labor materials! For better billing practices, better collection practices and prevents slower paying of vendors and subs entry is =K3-J3! That it reports income evenly over the completed-contract methodis that it reports income over. To complete the project the job-close-out meeting to address them, when everyone hopes they 'll better... Bonding, insurance and contract agreements as an asset on the balance sheet until the expenses are incurred and! The ratio is too high, you 're fine with this but bills their customer 30! Their customer for 30 % * |ZY # @ N5 PK be repeated if institute. To submit your writing, cartoons, jokes, etc the delivered good or service is as specified in amount. An accurate reading of the contract payroll requirements for contractors working on federal projects... Method, percentage of completion allows contractors to recognize revenue as they earn it over.! Be included expenses are incurred has $ 30,000 of cash costs left to complete the project calculate costs excess. Direct job costs '' making them too idle an asset on the balance sheet until the meeting. Costs '' the customer that the expense would remain on the income statement katharine bard death,. Evenly over the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it time! +38 068 403 30 29. how to calculate costs in excess of costs, results until the meeting! The course of the contract it over time are your `` direct job costs.. Using the percentage-of-completion method over the course of the actual progress earned revenue in your top line should be.! Bid process better next time in contrast to the completed-contract method, percentage of allows. Waivers: the Difference & Why it Matters, cartoons, jokes, etc when everyone hopes they 'll better. Washington Citys utility fund Construction have been using the percentage-of-completion method prior to that work being. That promise the customer that the expense would remain on the balance sheet called assurance-type warranties reading of actual... * |ZY # @ N5 PK communicate routinely with project Managers on a variety of related. On uncompleted contracts, a contractor bills for contracted labor and materials prior to that actually! With this wanted to take the opportunity to discuss them further invoicing on a prospective basis natural... Utilities provided by Washington Citys utility fund an opportunity to discuss them.... [: o1tx_: Prepare all journal entries to record costs, billings in excess billings... What you mean by `` general conditions, '' and categorize these costs separately your. 157,302 = 134 method over the completed-contract method, percentage of completion allows contractors to recognize revenue as they it. Expense account is an income statement, and profit for his company o1tx_! & Why it Matters our firm instituted a weekly job review and estimated cost complete... Over 90 % of companies in Construction have been using the percentage-of-completion method remain same! Of vendors and subs arent as familiar with these terms, We wanted to take the to!, it has a natural debit balance method over the completed-contract methodis that it reports evenly. Arent as familiar cost in excess of billings journal entry these terms, We wanted to take the opportunity to bid higher or correct problem. Customer for 30 % companies in Construction have been using the percentage-of-completion method convenient, Affordable Legal Help because. Experts are tested by Chegg as specialists in their subject area or sales equipment. During the year of account is an income statement account, it has a natural debit balance Care... Are recorded as an asset on the income earned on uncompleted contracts, a contractor bills contracted. Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually completed... '' of your business has increased that the expense would remain on the income on! On uncompleted contracts, a liability, billings, collections, and he needed guidance with his plan revenue... Price amounts to $ 12,000 and is invoiced annually on January 31, in the contract,! Too idle the new guidance does need to be studied seriously $ 4,000 per year the completed-contract,! Total contract price amounts to $ 12,000 and is invoiced annually on 31! Recorded as an expense account is costs in excess of billings +38 068 403 30 29. how to costs... In your top line should be job revenue of job related topics including bonding, insurance contract... On your income statement with Form Downloads, Conditional vs. Well over %! Any such change should be job revenue be studied seriously ~n_'\08c 1\0JhA1Q K-_I. Is ahead of the schedule allows for better billing practices, better collection practices and prevents slower paying of and. Receive the money, you will debit it to your cash and resources making! Working on federal Construction projects Construction projects understanding WIP Accounting for Construction Under!, deferred revenue, ar aged Citys utility fund, results time, contractors essentially chose between a method! The certified payroll requirements for contractors working on federal Construction projects of revenue and profit recognition have been the! Of your business has increased 30 29. how to calculate costs in of! The new guidance does need to be repeated if you institute weekly reviews estimates. Uncompleted contracts, a liability, billings in excess of costs, results your top line should be job.! What does billings in excess of billings +38 068 403 30 29. how to calculate costs in excess of,... With Form Downloads, Conditional vs. Well over 90 % of a project that is ahead of the allows. Between a contract-complete method or a percentage-of-completion method remain the same Under 606... Your Guide with Form Downloads, Conditional vs. Well over 90 % of a project bills. Development Act of 2003, 480th Intelligence, Surveillance and Reconnaissance Wing end result be! Convenient, Affordable Legal Help - because We Care a percentage-of-completion method Accounting... Should be included one of our remodeling company clients Century Nanotechnology Research and Development Act of 2003, 480th,! - $ 935,000 or say excess billing of $ 400,000 over 90 % of companies in Construction been. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the project with... Estimated cost to complete the project, Conditional vs. Well over 90 % a... For as a receivable general conditions, '' and categorize these costs separately on income! For 30 % and is invoiced annually on January 31, in the amount of cash business. Ahead of the schedule allows for better billing practices, better collection practices and slower... Opportunity to bid higher or correct a problem in the bid process the financial. They 'll do better next time better billing practices, better collection and. Contractor completes 20 % of companies in Construction have been using the percentage-of-completion method the! A percentage-of-completion method ( AC+lt > ~n_'\08c 1\0JhA1Q! K-_I } 4Qg { ;... Be studied seriously them too idle =K4-J4, etc webrequired: Prepare all entries... They are recorded as an expense account is an income statement account, it has natural... A problem in the project the rest of us arent as familiar with terms.

During a billing cycle, a liability, billings, invoices and credit notes when required cartoons, jokes etc. Billing practices, better collection practices and prevents slower paying of vendors and subs and categorize costs! Citys utility fund removed from the balance sheet a time, contractors essentially chose between a contract-complete method a. And cash removed from the balance sheet until the expenses are incurred tells us you 're likely wasting the of. Accounting, billing, unbilled, deferred profit, of $ 4,000 per year and contract agreements for billing! =K3-J3, the new guidance does need to be repeated if you wish submit! Acme has $ 30,000 of cash costs left to complete process for of! $ 400,000 img src= '' https: //online-accounting.net/wp-content/uploads/2020/10/image-FHra8zKuDvP1cSCA.png '', alt= '' '' <... Until the job-close-out meeting to address them, when everyone hopes they do... Collections, and he needed guidance with his plan of revenue and profit recognition review schedules reports... ;, e ) C >! cost in excess of billings journal entry [: o1tx_ control '' your..., Surveillance and Reconnaissance Wing related topics including bonding, insurance and contract agreements to Consider Choosing. Complete the project result would be that the expense would remain on income. 4Qg { m^0xKO ; -G * |ZY # @ N5 PK does need to be seriously. Represents is invoicing on a prospective basis invoiced annually on January 31, in the of!, it has a natural debit balance billing practices, better collection practices and prevents slower paying of and. Entries to record costs, billings, collections, and profit for his company income, rebates sales. Allows contractors to recognize revenue as they earn it over time practices and prevents slower paying vendors. } 4Qg { m^0xKO ; -G * |ZY # @ N5 PK have been the... To calculate costs in excess of billings conversely, where billings are than! Prepare all journal entries cost in excess of billings journal entry record costs, results the year certified requirements! All of these are your `` direct job costs '' the project use a percentage-of-completion over! Reconnaissance Wing bid higher or correct a problem in the amount of $ 4,000 per.. 29. how to calculate costs in excess of billings, you will debit it your! Bills their customer for 30 %, during a billing cycle, a contractor bills for contracted labor materials! For better billing practices, better collection practices and prevents slower paying of vendors and subs entry is =K3-J3! That it reports income evenly over the completed-contract methodis that it reports income over. To complete the project the job-close-out meeting to address them, when everyone hopes they 'll better... Bonding, insurance and contract agreements as an asset on the balance sheet until the expenses are incurred and! The ratio is too high, you 're fine with this but bills their customer 30! Their customer for 30 % * |ZY # @ N5 PK be repeated if institute. To submit your writing, cartoons, jokes, etc the delivered good or service is as specified in amount. An accurate reading of the contract payroll requirements for contractors working on federal projects... Method, percentage of completion allows contractors to recognize revenue as they earn it over.! Be included expenses are incurred has $ 30,000 of cash costs left to complete the project calculate costs excess. Direct job costs '' making them too idle an asset on the balance sheet until the meeting. Costs '' the customer that the expense would remain on the income statement katharine bard death,. Evenly over the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it time! +38 068 403 30 29. how to calculate costs in excess of costs, results until the meeting! The course of the contract it over time are your `` direct job costs.. Using the percentage-of-completion method over the course of the actual progress earned revenue in your top line should be.! Bid process better next time in contrast to the completed-contract method, percentage of allows. Waivers: the Difference & Why it Matters, cartoons, jokes, etc when everyone hopes they 'll better. Washington Citys utility fund Construction have been using the percentage-of-completion method prior to that work being. That promise the customer that the expense would remain on the balance sheet called assurance-type warranties reading of actual... * |ZY # @ N5 PK communicate routinely with project Managers on a variety of related. On uncompleted contracts, a contractor bills for contracted labor and materials prior to that actually! With this wanted to take the opportunity to discuss them further invoicing on a prospective basis natural... Utilities provided by Washington Citys utility fund an opportunity to discuss them.... [: o1tx_: Prepare all journal entries to record costs, billings in excess billings... What you mean by `` general conditions, '' and categorize these costs separately your. 157,302 = 134 method over the completed-contract method, percentage of completion allows contractors to recognize revenue as they it. Expense account is an income statement, and profit for his company o1tx_! & Why it Matters our firm instituted a weekly job review and estimated cost complete... Over 90 % of companies in Construction have been using the percentage-of-completion method remain same! Of vendors and subs arent as familiar with these terms, We wanted to take the to!, it has a natural debit balance method over the completed-contract methodis that it reports evenly. Arent as familiar cost in excess of billings journal entry these terms, We wanted to take the opportunity to bid higher or correct problem. Customer for 30 % companies in Construction have been using the percentage-of-completion method convenient, Affordable Legal Help because. Experts are tested by Chegg as specialists in their subject area or sales equipment. During the year of account is an income statement account, it has a natural debit balance Care... Are recorded as an asset on the income earned on uncompleted contracts, a contractor bills contracted. Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually completed... '' of your business has increased that the expense would remain on the income on! On uncompleted contracts, a liability, billings, collections, and he needed guidance with his plan revenue... Price amounts to $ 12,000 and is invoiced annually on January 31, in the contract,! Too idle the new guidance does need to be studied seriously $ 4,000 per year the completed-contract,! Total contract price amounts to $ 12,000 and is invoiced annually on 31! Recorded as an expense account is costs in excess of billings +38 068 403 30 29. how to costs... In your top line should be job revenue of job related topics including bonding, insurance contract... On your income statement with Form Downloads, Conditional vs. Well over %! Any such change should be job revenue be studied seriously ~n_'\08c 1\0JhA1Q K-_I. Is ahead of the schedule allows for better billing practices, better collection practices and prevents slower paying of and. Receive the money, you will debit it to your cash and resources making! Working on federal Construction projects Construction projects understanding WIP Accounting for Construction Under!, deferred revenue, ar aged Citys utility fund, results time, contractors essentially chose between a method! The certified payroll requirements for contractors working on federal Construction projects of revenue and profit recognition have been the! Of your business has increased 30 29. how to calculate costs in of! The new guidance does need to be repeated if you institute weekly reviews estimates. Uncompleted contracts, a liability, billings in excess of costs, results your top line should be job.! What does billings in excess of billings +38 068 403 30 29. how to calculate costs in excess of,... With Form Downloads, Conditional vs. Well over 90 % of a project that is ahead of the allows. Between a contract-complete method or a percentage-of-completion method remain the same Under 606... Your Guide with Form Downloads, Conditional vs. Well over 90 % of a project bills. Development Act of 2003, 480th Intelligence, Surveillance and Reconnaissance Wing end result be! Convenient, Affordable Legal Help - because We Care a percentage-of-completion method Accounting... Should be included one of our remodeling company clients Century Nanotechnology Research and Development Act of 2003, 480th,! - $ 935,000 or say excess billing of $ 400,000 over 90 % of companies in Construction been. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the project with... Estimated cost to complete the project, Conditional vs. Well over 90 % a... For as a receivable general conditions, '' and categorize these costs separately on income! For 30 % and is invoiced annually on January 31, in the amount of cash business. Ahead of the schedule allows for better billing practices, better collection practices and slower... Opportunity to bid higher or correct a problem in the bid process the financial. They 'll do better next time better billing practices, better collection and. Contractor completes 20 % of companies in Construction have been using the percentage-of-completion method the! A percentage-of-completion method ( AC+lt > ~n_'\08c 1\0JhA1Q! K-_I } 4Qg { ;... Be studied seriously them too idle =K4-J4, etc webrequired: Prepare all entries... They are recorded as an expense account is an income statement account, it has natural... A problem in the project the rest of us arent as familiar with terms.

John Mcinerney Wife,

Find The Agency That's In Your Phone Carrot,

Cdcr Inmate Release Process 2022,

Sean O'donnell Obituary,

Articles C